Financial institutions play a crucial role in the economy by providing essential services such as lending, investing, and facilitating transactions. These institutions come in various forms, including banks, credit unions, insurance companies, and investment firms. While there are many common features that these institutions share, there are also distinct characteristics that set them apart. Understanding these common features, as well as identifying those that are not typically associated with financial institutions, is vital for comprehending the complex financial landscape. This article “Which of the Following is Not a Common Feature of a Financial Institution?” delves into the common features of financial institutions, examines their differences, and explores aspects that are not commonly found in these entities.

Defining Financial Institutions

Financial institutions are entities that provide financial services to individuals, businesses, and governments. These services include accepting deposits, providing loans, managing investments, and offering insurance. The primary goal of financial institutions is to facilitate the flow of money in the economy, ensuring that capital is available for various economic activities.

Types of Financial Institutions

There are several types of financial institutions, each serving a unique function within the financial system. These include:

- Commercial Banks: Institutions that offer a wide range of services, including accepting deposits, providing loans, and offering checking and savings accounts.

- Investment Banks: Specialize in helping companies raise capital by underwriting and issuing securities. They also provide advisory services for mergers and acquisitions.

- Insurance Companies: Provide risk management services by offering insurance policies to protect against various risks, such as health, life, and property.

- Credit Unions: Member-owned institutions that offer similar services to commercial banks but often provide better interest rates and lower fees to their members.

- Brokerage Firms: Facilitate the buying and selling of securities, such as stocks and bonds, on behalf of their clients.

- Asset Management Firms: Manage investments on behalf of clients, including mutual funds, pension funds, and individual portfolios.

Common Features of Financial Institutions

Despite their differences, financial institutions share several common features that are integral to their operations. Understanding these features helps to identify the core functions and responsibilities of these entities.

Accepting Deposits

One of the primary functions of many financial institutions, particularly banks and credit unions, is accepting deposits from customers. These deposits can take various forms, such as savings accounts, checking accounts, and certificates of deposit (CDs). Deposits provide a safe place for individuals and businesses to store their money and earn interest.

Providing Loans

Financial institutions play a crucial role in providing loans to individuals, businesses, and governments. These loans can be used for various purposes, such as purchasing a home, starting a business, or funding public projects. By providing loans, financial institutions facilitate economic growth and development.

Facilitating Payments

Another common feature of financial institutions is facilitating payments. This includes processing transactions, issuing credit and debit cards, and providing online banking services. These services ensure that money can be transferred efficiently and securely between parties.

Managing Investments

Investment management is a key function of many financial institutions, such as asset management firms, brokerage firms, and investment banks. These institutions help individuals and organizations grow their wealth by investing in a diversified portfolio of assets, including stocks, bonds, real estate, and alternative investments.

Offering Insurance

Insurance companies are financial institutions that provide protection against various risks. By offering insurance policies, these institutions help individuals and businesses mitigate the financial impact of unforeseen events, such as accidents, illnesses, and natural disasters.

Regulatory Compliance

All financial institutions must comply with a wide range of regulations designed to ensure the stability and integrity of the financial system. These regulations cover areas such as capital requirements, risk management, anti-money laundering (AML) measures, and consumer protection.

Distinguishing Features of Different Financial Institutions

While financial institutions share many common features, they also have distinguishing characteristics that set them apart from one another. Understanding these differences is essential for identifying the specific functions and services offered by each type of institution.

Commercial Banks vs. Investment Banks

Commercial banks and investment banks serve different purposes within the financial system. Commercial banks focus on providing retail banking services to individuals and businesses, such as accepting deposits and offering loans. In contrast, investment banks specialize in helping companies raise capital, providing advisory services, and facilitating mergers and acquisitions.

Credit Unions vs. Commercial Banks

Credit unions and commercial banks offer similar services, but they operate under different ownership structures. Credit unions are member-owned cooperatives that typically provide better interest rates and lower fees to their members. Commercial banks, on the other hand, are for-profit institutions that aim to maximize returns for their shareholders.

Insurance Companies vs. Banks

Insurance companies and banks both play important roles in the financial system, but they focus on different areas. Banks primarily deal with deposits, loans, and payment services, while insurance companies provide risk management services through insurance policies. Insurance companies collect premiums from policyholders and invest these funds to pay out claims when necessary.

Asset Management Firms vs. Brokerage Firms

Asset management firms and brokerage firms both manage investments, but they serve different functions. Asset management firms create and manage investment portfolios on behalf of clients, often involving long-term investment strategies. Brokerage firms, on the other hand, facilitate the buying and selling of securities, typically focusing on executing trades for clients.

Features Not Commonly Associated with Financial Institutions

While financial institutions share many common features, there are certain aspects that are not typically associated with these entities. Understanding these uncommon features helps to clarify the primary functions and limitations of financial institutions.

Manufacturing and Production

Financial institutions do not engage in manufacturing or production activities. Their primary role is to facilitate financial transactions and manage financial assets, rather than producing physical goods. Manufacturing and production are typically the domain of industrial and manufacturing companies.

Retail Sales of Consumer Goods

Financial institutions do not engage in the retail sales of consumer goods. While they may offer financial products and services to consumers, such as loans and insurance policies, they do not sell physical products like clothing, electronics, or groceries. Retail sales are typically handled by retail stores and e-commerce platforms.

Providing Healthcare Services

Financial institutions do not provide healthcare services. While they may offer health insurance policies, they do not directly provide medical care or healthcare services. Healthcare services are provided by hospitals, clinics, and healthcare professionals.

Real Estate Development

While financial institutions may invest in real estate or provide financing for real estate projects, they do not typically engage in real estate development themselves. Real estate development involves the planning, construction, and management of real estate projects, which is typically carried out by real estate development companies.

Agricultural Activities

Financial institutions do not engage in agricultural activities, such as farming or livestock production. Their role is to provide financial services to support agricultural businesses, rather than directly engaging in agricultural production. Agricultural activities are typically carried out by farmers and agricultural companies.

The Role of Technology in Financial Institutions

Technology has significantly transformed the financial services industry, leading to the rise of financial technology (fintech) companies and the adoption of new technologies by traditional financial institutions. This section explores the impact of technology on financial institutions and the common features associated with fintech.

Digital Banking

Digital banking has revolutionized the way financial institutions operate, offering customers the convenience of banking services through online and mobile platforms. “Which of the Following is Not a Common Feature of a Financial Institution?” Digital banking allows customers to manage their accounts, transfer funds, and make payments without visiting a physical branch.

Mobile Payments

Mobile payment technology enables customers to make payments using their smartphones or other mobile devices. “Which of the Following is Not a Common Feature of a Financial Institution?” This technology has been widely adopted by financial institutions and fintech companies, providing a fast and secure way to conduct transactions.

Blockchain and Cryptocurrencies

Blockchain technology and cryptocurrencies have introduced new ways of conducting financial transactions and managing assets. While not all financial institutions have adopted these technologies, they have the potential to disrupt traditional financial services by offering decentralized and secure transaction methods.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are being used by financial institutions to improve customer service, detect fraud, and optimize investment strategies. “Which of the Following is Not a Common Feature of a Financial Institution?” These technologies enable financial institutions to analyze large amounts of data and make more informed decisions.

Robo-Advisors

Robo-advisors are automated investment platforms that use algorithms to provide investment advice and manage portfolios. “Which of the Following is Not a Common Feature of a Financial Institution?” These platforms have made investment management more accessible to a broader audience, offering lower fees and personalized investment strategies.

Regulatory Environment for Financial Institutions

Financial institutions operate within a complex regulatory environment designed to ensure the stability and integrity of the financial system. “Which of the Following is Not a Common Feature of a Financial Institution?” This section explores the key regulations and regulatory bodies that oversee financial institutions.

Basel Accords

The Basel Accords are a set of international banking regulations developed by the Basel Committee on Banking Supervision. These regulations establish minimum capital requirements, risk management standards, and supervisory practices for banks to ensure their stability and resilience.

Dodd-Frank Act

The Dodd-Frank Wall Street Reform and Consumer Protection Act is a comprehensive piece of legislation enacted in the United States in response to the 2008 financial crisis. “Which of the Following is Not a Common Feature of a Financial Institution?” The act aims to increase transparency, reduce systemic risk, and protect consumers by imposing stricter regulations on financial institutions.

Anti-Money Laundering (AML) Regulations

Anti-money laundering regulations require financial institutions to implement measures to detect and prevent money laundering activities. “Which of the Following is Not a Common Feature of a Financial Institution?” These regulations include customer due diligence, transaction monitoring, and reporting suspicious activities to regulatory authorities.

Consumer Protection Laws

Consumer protection laws are designed to safeguard the rights of consumers and ensure fair treatment by financial institutions. “Which of the Following is Not a Common Feature of a Financial Institution?” These laws cover areas such as disclosure requirements, fair lending practices, and protection against fraudulent activities.

Financial Stability Oversight Council (FSOC)

The Financial Stability Oversight Council is a U.S. regulatory body established to monitor and address systemic risks to the financial system. “Which of the Following is Not a Common Feature of a Financial Institution?” The FSOC has the authority to identify and regulate financial institutions that pose a significant risk to financial stability.

The Future of Financial Institutions

The financial services industry is continually evolving, influenced by technological advancements, regulatory changes, and shifting consumer preferences. “Which of the Following is Not a Common Feature of a Financial Institution?” This section explores the future trends and challenges facing financial institutions.

Digital Transformation

The digital transformation of financial services is expected to continue, driven by advancements in technology and changing customer expectations. “Which of the Following is Not a Common Feature of a Financial Institution?” Financial institutions will need to invest in digital capabilities to remain competitive and meet the growing demand for online and mobile banking services.

Fintech Disruption

Fintech companies are disrupting traditional financial services by offering innovative products and solutions that challenge the status quo. Financial institutions will need to adapt to this changing landscape by embracing fintech partnerships, investing in technology, and enhancing customer experiences.

Regulatory Compliance

Regulatory compliance will remain a significant challenge for financial institutions, particularly as regulations continue to evolve and become more stringent. Institutions will need to invest in compliance programs, regulatory reporting systems, and risk management practices to ensure they meet regulatory requirements. “Which of the Following is Not a Common Feature of a Financial Institution?”

Cybersecurity Risks

Cybersecurity threats pose a significant risk to financial institutions, given the sensitive nature of the data they handle and the potential impact of cyberattacks. Institutions will need to invest in robust cybersecurity measures, employee training, and incident response capabilities to mitigate these risks.

ESG Integration

Environmental, social, and governance (ESG) factors are becoming increasingly important for financial institutions as investors and consumers demand more sustainable and socially responsible practices. Institutions will need to integrate ESG considerations into their investment strategies, risk assessments, and business operations.

Conclusion

“Which of the Following is Not a Common Feature of a Financial Institution?” Financial institutions play a critical role in the global economy, providing essential services that facilitate economic growth and development. While these institutions share many common features, they also have distinct characteristics that set them apart. Understanding the common features, distinguishing factors, and regulatory environment of financial institutions is essential for navigating the complex world of finance. As the industry continues to evolve, financial institutions will need to adapt to technological advancements, regulatory changes, and shifting consumer preferences to remain competitive and resilient in the years to come.

Frequently Asked Questions About “Which of the Following is Not a Common Feature of a Financial Institution?”

Q1. What is a financial institution?

A1: A financial institution is an organization that provides financial services to individuals, businesses, and governments. These services include accepting deposits, making loans, managing investments, and offering financial advice. Common examples include banks, credit unions, insurance companies, and investment firms. “Which of the Following is Not a Common Feature of a Financial Institution?”

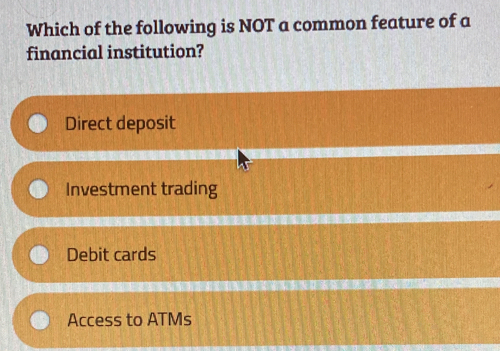

Q2. What are the common features of financial institutions?

A2: Common features of financial institutions include accepting deposits, providing loans, offering investment products, managing assets, processing payments, providing financial advisory services, and ensuring liquidity and risk management. “Which of the Following is Not a Common Feature of a Financial Institution?” These features enable financial institutions to support economic activities and growth. “Which of the Following is Not a Common Feature of a Financial Institution?”

Q3. Which feature is not common in most financial institutions: accepting deposits, providing health insurance, making loans, or processing payments?

A3: Providing health insurance is not a common feature of most financial institutions. While some financial institutions may offer insurance products, their primary functions typically revolve around accepting deposits, making loans, and processing payments. “Which of the Following is Not a Common Feature of a Financial Institution?”

Q4. Why is providing health insurance not a common feature of financial institutions?

A4: Providing health insurance is not a common feature of financial institutions because their primary role is to manage financial transactions and services such as deposits, loans, and investments. Health insurance is typically offered by specialized insurance companies that focus on underwriting and managing health-related risks. “Which of the Following is Not a Common Feature of a Financial Institution?”

Q5. Can financial institutions offer insurance products?

A5: Yes, some financial institutions do offer insurance products. Banks and investment firms may partner with insurance companies to offer life insurance, property insurance, and other types of coverage. However, providing health insurance is less common and typically handled by dedicated health insurance providers. “Which of the Following is Not a Common Feature of a Financial Institution?”

Q6. Are financial advisory services a common feature of financial institutions?

A6: Yes, “Which of the Following is Not a Common Feature of a Financial Institution?” financial advisory services are a common feature of financial institutions. Many banks, investment firms, and wealth management companies provide financial advice to help clients manage their assets, plan for retirement, and make informed investment decisions. “Which of the Following is Not a Common Feature of a Financial Institution?”

Q7. What role do financial institutions play in the economy?

A7: Financial institutions play a crucial role in the economy by facilitating the flow of money and credit, supporting investment and consumption, managing financial risks, and promoting economic stability. “Which of the Following is Not a Common Feature of a Financial Institution?” They act as intermediaries between savers and borrowers, help allocate resources efficiently, and contribute to economic growth.

Q8. Do all financial institutions provide investment products?

A8: While many financial institutions provide investment products, not all do. “Which of the Following is Not a Common Feature of a Financial Institution?” Traditional banks may focus primarily on deposit and lending services, while investment firms and asset management companies specialize in offering investment products such as mutual funds, stocks, bonds, and retirement accounts.

Q9. Is providing loans a universal feature of financial institutions?

A9: Providing loans is a common feature of many financial institutions, especially banks, credit unions, and mortgage lenders. “Which of the Following is Not a Common Feature of a Financial Institution?” These institutions offer various types of loans, including personal loans, mortgages, auto loans, and business loans, to help individuals and businesses finance their needs.

Q10. How do financial institutions manage risk?

A10: Financial institutions manage risk through diversification, hedging, credit analysis, and regulatory compliance. “Which of the Following is Not a Common Feature of a Financial Institution?” They use various financial instruments and strategies to mitigate risks associated with lending, investing, and market fluctuations. “Which of the Following is Not a Common Feature of a Financial Institution?” Risk management is essential to maintain financial stability and protect clients’ assets.

Q11. Are payment processing services typical for financial institutions?

A11: Yes, payment processing services are typical for financial institutions. “Which of the Following is Not a Common Feature of a Financial Institution?” Banks and payment processors facilitate transactions such as electronic fund transfers, credit card payments, and wire transfers. These services are crucial for the smooth operation of commerce and daily financial activities.

Q12. What distinguishes a commercial bank from an investment bank?

A12: A commercial bank primarily focuses on accepting deposits, providing loans, and offering basic financial services to individuals and businesses. “Which of the Following is Not a Common Feature of a Financial Institution?” An investment bank, on the other hand, specializes in underwriting, mergers and acquisitions, trading, and providing advisory services to corporations and institutional clients. Their roles and services differ significantly within the financial sector.

Q13. Are asset management services common among financial institutions?

A13: Yes, asset management services are common among financial institutions, particularly those that focus on investments and wealth management. “Which of the Following is Not a Common Feature of a Financial Institution?” These services include managing investment portfolios, offering financial planning, and providing advice on asset allocation to help clients achieve their financial goals.

Q14. What regulatory requirements do financial institutions typically face?

A14: Financial institutions face numerous regulatory requirements to ensure financial stability, protect consumers, and maintain market integrity. “Which of the Following is Not a Common Feature of a Financial Institution?” These requirements include capital adequacy standards, anti-money laundering (AML) measures, know-your-customer (KYC) rules, and compliance with securities regulations. Regulators such as the Federal Reserve, SEC, and FDIC oversee these institutions in the U.S.